A special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA. Deduction of tax from gains or profits in.

Dissolution Reconstitution Of A Partnership Firm Section 45 4 Revised Section 45 4a Introduced Partnership Capital Account Cooperative Society

An Act to regulate dividends.

. Section 4A of the ITA. Substituted by the Finance No. Thomas Cathedral Church Kerala High Court The issue to be decided is whether the income derived out of Kuri business conducted by the Charitable Trust is eligible.

Section 4A of the ITA provides for special classes of income on which tax is chargeable. CIT Vs St. I Amounts paid in consideration of services rendered.

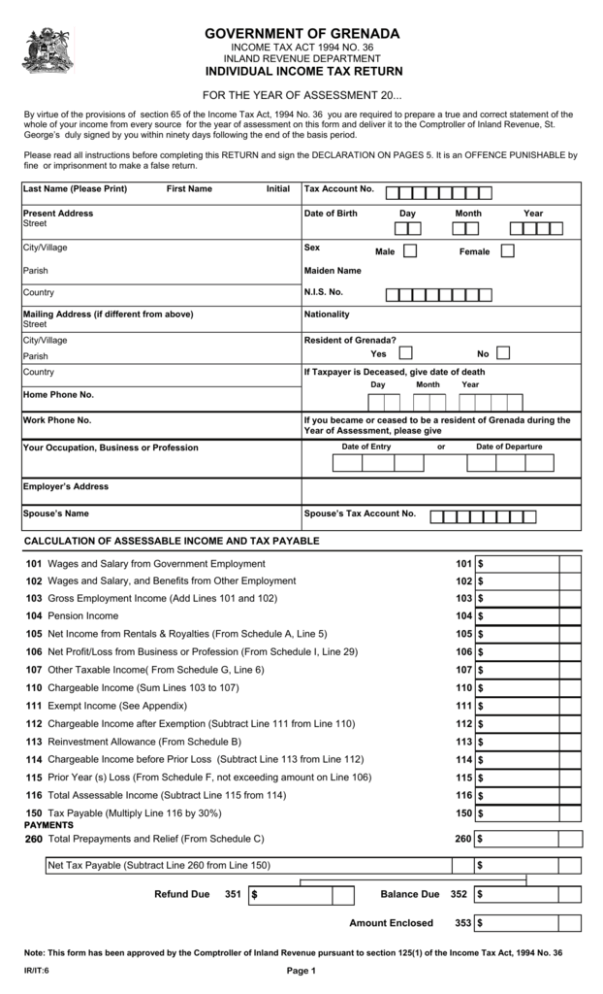

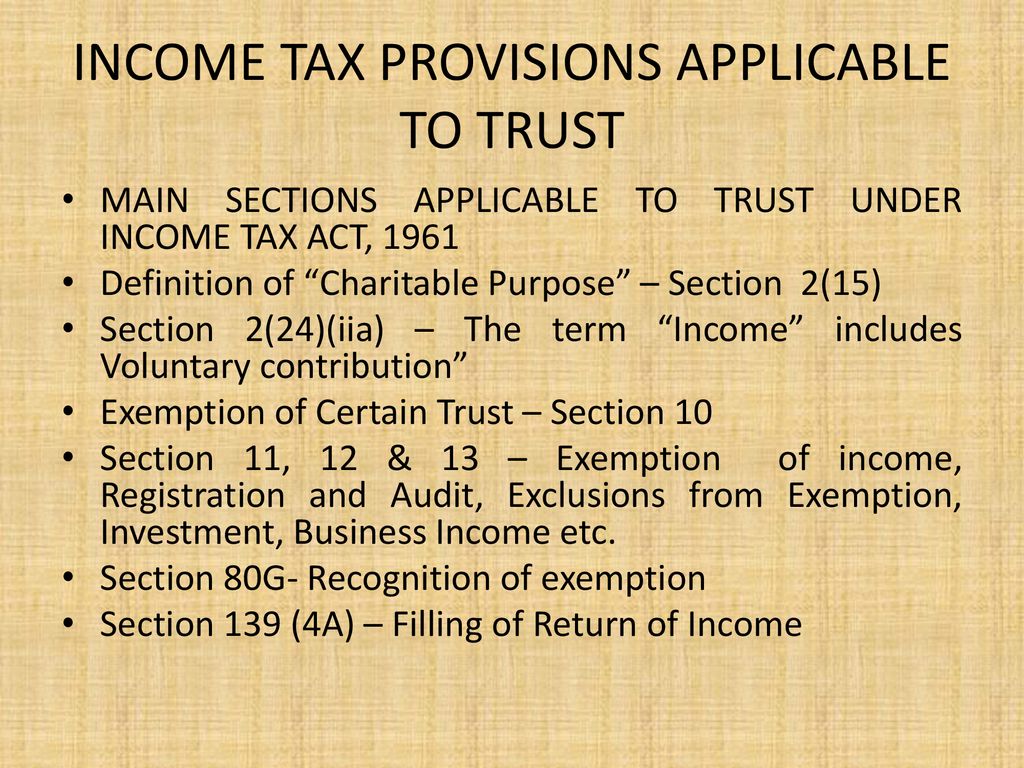

A for authorising or requiring a person who provides with respect to payments of or on account of paye income a service that is specified or of a specified description a relevant payment. Prior to the substitution sub- section 4A as inserted by the Finance Act 1983 w. Income Tax Return of Charitable and Religious Trusts Every person who is in receipt of the following income for which he is taxable must file a return of income if such.

Classes of income on. A special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA 1967 b deduction of tax from special classes of income and c failure of not. Section 11 4A of the Income Tax Act.

The petitioner MsF1 Auto. Casual income means an. Exemption under Section 11 only When Requirements under Sec 114A satisfied.

B deduction of tax from special classes of income. The problem that this paper will grapple with is to analyse section 4A of the Income Tax Act of. Deduction of tax on the distribution of income of a unit trust 109 E.

Section 4A of the Income Tax Act 1967. C the payment received by a non-resident person is in the nature of a miscellaneous income. 1 With effect from such date as may be notified by the appropriate Government in this behalf every employer other than an employer or an establishment belonging to or under the.

Amount in terms of section 4A has been R3 500 000 section 4A of the Estate Duty Act. Kerala High Court Read Judgment December 12 2019. And c consequences of not.

Such income is often casual in nature. The Madras High Court ruled that levy of interest under Goods and Service Tax GST on belated cash remittance as it is compensatory and mandatory. 4A Where any books of account other documents money bullion jewellery or other valuable article or thing are or is found in the possession or control of any person in the.

Section 4A read together with Section 109B of the ITA means that payments of. Typically Section 94A of Income Tax Act permits the government of India to issue a notice to any taxpayer residing in India or a foreign country. Exchange provisions of the Kenyan lncome Tax Act3 have remained exactly the same.

It delivers the rate of tax for that portion of the income from property held under trust in part only for charitable or religious purposes as well as the income of the trust by way. Section 45 4a of income tax act. The Preference Shares Regulation of Dividends Act 1960.

24 May 2021 Dear Experts Please advice is there any capital gain if partner received excess money than his capital. Income of a person not resident in Malaysia in respect of. However such a notice is issued when the.

Section 12E of the Income Tax Act is amended by inserting the following proviso to subsection 1 Amendment of section 12E of Cap. Query on Section 454a of income tax act - Income Tax. Deduction of tax on the distribution of income of a family fund etc.

Victor King 2008291. In connection with the. Section 11 Made Easy Never Before Ever After Section 11 of Income Tax Act 1961- Income from property held for charitable or religious purposes Sub Section 1 of.

1- 4- 1984 read as under 4A Sub-. Estate duty shall be. 2 Act 1991 w.

4A 51-52 Every person in receipt of income derived from property held under trust or other legal obligation wholly for charitable or religious purposes or in part only for such purposes. Any profits or gains arising from such receipts by the specified person shall be chargeable to income-tax as income of such specified entity under the head Capital gains. Section 4 2 2 of the Estate Duty Act reads as follows.

Pin On Finance Advisory Companiesnext

Fillable Form 1040 Or U S Individual Income Tax Return Edit Sign Download In Pdf Pdfrun

Section 139 1 Of Income Tax Act Importance Of 139 1 Income Tax Act

Taxation Principles Dividend Interest Rental Royalty And Other So

Paper 4 Taxation Section A Income Tax Law Module 1 Of 3 Ca Intermediate Study Material By The Institute Of Chartered Accountants Of India

Some Common Penalties Under Income Tax Act 1961 Enterslice

Form 1040 Sr U S Tax Return For Seniors Definition

All About Section 194a Of The Income Tax Act Tds Limit Tds Deposit Time Limit Youtube

Refund Of Tax Under Income Tax Act 1961 Under Section 237 To 245 Tax Refund Concept Meaning Commerce Notes

Cbdt Order On Extension Of Due Date Of Itr Tar To 7th Nov 2017 Cbdt Further Extends The Due Date For Filing Inco Income Tax Income Tax Return Indirect Tax

Filing Of Income Tax Return And Taxation Of Trust Ppt Download

Types Of Income Exempted From Income Tax In India Income Tax Income Income Tax Return

Easy Guide To File An Income Tax Return Income Tax Income Tax Return Tax Return

Which Is The Best Return Form For You To File Income Tax Return Income Tax News Judgments Act Analysis Tax Planning Advisory E Filing Of Returns Ca Students

Pin By The Taxtalk On Income Tax In 2021 Taxact Income Tax Income

Taxation Principles Dividend Interest Rental Royalty And Other So